Today, March 9th, 2020, was a bad day for the financial markets. Almost all of us (including myself) are counting on the financial markets to help us meet our retirement goals, and days like today are scary because they remind us that the markets don’t care about our retirements. We often talk about investing as piggy-backing off of capitalism, but the markets aren’t worried about us falling off. That said, we need to step back and try and sort out what actually happened today, because there was a lot going on.

There are four main elements to this story that I want to pick apart: 1) the oil price war between Saudi Arabia and Russia, 2) the bond market, 3) future stock volatility, and 4) the overall stock market.

The Oil Price War

To start off with, let’s look at the price war between Saudi Arabia and Russia. Saudi Arabia wanted OPEC+ (essentially OPEC plus Russia) to cut production because of the decrease in demand for oil caused by the Coronavirus. Russia does not want to do so, and in response Saudi Arabia opened the spigots. This caused the price of crude oil to plummet by nearly a third.

So what does this actually mean? Well, there are a couple of threads to untangle. For most of the economy this is actually a good thing. Oil is one of the most basic inputs in our economy. It’s used in practically everything – either to make it directly (and it’s used to make a lot more things than most people think) or to get those things to wherever they need to be. Now we can all buy it more cheaply than we could last week. That’s a good thing.

On the other hand, energy producers are not as happy. All of the gains across the rest of the economy are being borne by the (relatively) small number of energy producers, so they are in for a rough ride until Saudi Arabia and Russia sort this out (it’s worth noting that this dynamic is one of the big reasons why we aren’t big fans of investing in commodities). Both countries seem to be ready for a protracted fight.

In the short term, this is probably a negative for the market. To the extent that the costs and benefits are absorbed by publicly traded firms the effect will roughly balance out, but the market doesn’t particularly like uncertainty around the price of oil. Especially when that uncertainty is caused by a street fight between two of the world’s biggest oil producers.

The Bond Market

We’ve been seeing a pretty pronounced flight to quality. When people are scared of the stock market, they look for the safest place to store their money, and US Treasury bonds are generally where they end up. This drives up the price of those bonds, and drives down the yields. As it stands right now (5pm on Monday evening) all of the yields on US Treasury bonds – all the way out to the 30 Year bond – are under 1%. Essentially, people just want to be confident that they are going to get their money back.

Aside from making stretching for yield even less useful, there are two countervailing effects that I want to point out given the overall economic situation. The first is that these lower interest rates mean that it will be easier for the government to borrow money for any potential fiscal stimulus that might be necessary to deal with the economic impacts of the Coronavirus. On the other side, with rates this low, the Fed doesn’t have much room to maneuver in terms of using monetary policy.

Volatility Will Likely Stick Around

As much as we might wish that this uncertainty in the markets are going to settle down, that seems unlikely for the time being. The VIX Index, which tracks the market’s estimate of the S&P 500 index’s volatility over the next month was up nearly 30% on Monday (which is it’s 37th biggest daily jump ever – and we’ve already had even bigger jumps on February 24th and 27th).

While the VIX isn’t perfect – it’s trying to predict the future, after all – it does a reasonably good job of estimating the future level of volatility in the markets. It doesn’t necessarily say anything about which way the markets will end up moving, just that they will be moving.

This is an important point. We are clearly in a period where there is a lot of information coming out that is pushing and pulling the financial markets all over the place. Frankly, most of that information is probably going to be bad information for a little while longer. From an investing standpoint, what matters is whether that new information is better or worse than what the markets expected. It’s clear that the market has already priced in some pretty negative expectations, so if the news is less bad than we all expect it to be then prices will go up, but we have no way of knowing how that will play out. Just about the only thing that we can say at this point is that there will be a lot of up and down before this all settles.

The Stock Market

There’s no real way to sugarcoat it; today was an awful one for the stock market. Given the news over the weekend, it was pretty clear that the market would be in for a rough day, and it lived up to its billing. The S&P 500 Index was down 7.6% on the day. Today was the 23rd worst day that the S&P 500 Index has had since 1928 in terms of percentage points. There was a lot of bad information that came out over the weekend, and clearly the market is expecting even more bad news (and as I’m writing this, Italy has extended their Coronavirus quarantine to the entire country).

While we have no idea what the markets will do in the future, I do want to point out that the worst thing that you can try and do is time the market. As the old saying goes, “time in the market is more important than timing the market.” It can be tempting to try and stop the bleeding by selling after a day like today, but that just means locking in these losses.

While I have no idea what the market will be doing tomorrow, it is worth noting that after really bad days, the stock market tends to do really well. For instance, since 1928, the day following one of the fifty worst days for the market the S&P 500 Index has been up 2.69% on average. To put that in perspective, over the same time period, the average daily return was 0.03%. On the other hand, the second and third worst days that the S&P 500 Index has seen were back to back. On October 28th, 1929 the Index was down 12.9%, and it was down another 10.2% on the 29th. And there were a few other sets of back to back days with truly horrendous returns mixed in there as well. But even with those sets of returns, the day after a huge drop does tend to see a sizable rebound. Overall, when the markets come back, they tend to rebound very quickly.

It’s important to remember that daily returns are essentially noise in the grand scheme of things, though. We have to live through these events, but when we start looking at them over a longer time frame, nearly all of the ups and downs get smoothed out.

From 1928 through 2019, the S&P 500 Index averaged an annual increase of 35 points[1]. However, if you look at how much it bounced around you saw a different story. When you add up the absolute value of all of the daily movements, the annual average movement was 822 points. This means that, on average, 90.4% of all of those daily changes that whipsaw us around cancel each other out.

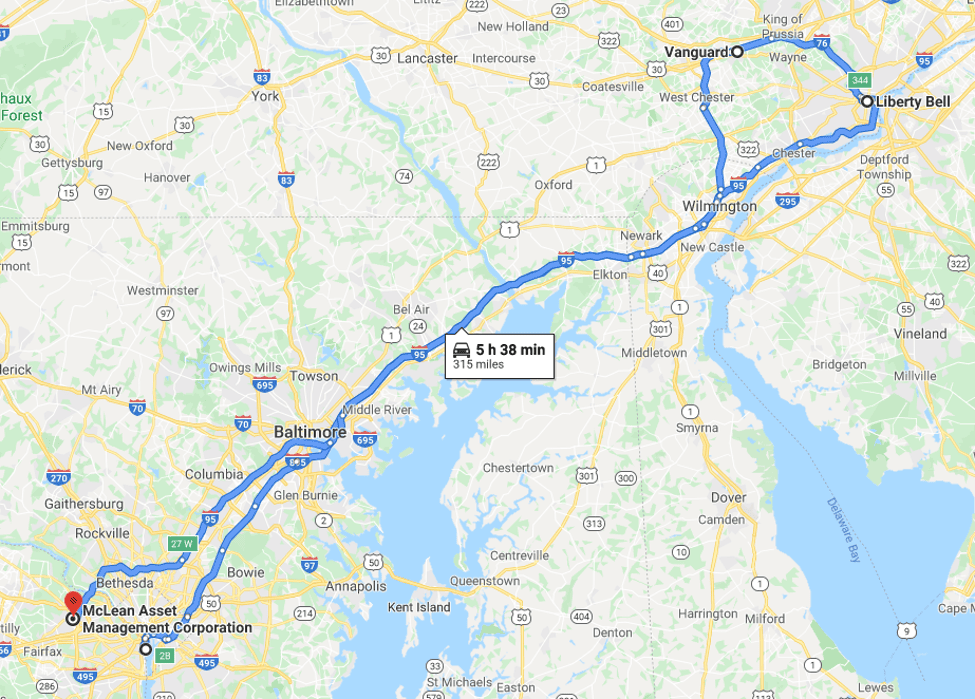

To put this in perspective, I live in Portland, Maine, and when I go into our main office, I tend to fly in through Reagan airport in DC. It’s a 14 mile trip from the airport to our offices in Tysons Corner, Virginia. To get to the market’s level of “extra” movement, instead of driving straight to the office, I would need to head up to Philadelphia to see the Liberty Bell, take a side trip to Vanguard’s head office in Malvern, and then head back down to our office (and even that’s a little bit short).

In conclusion, today was a scary day in the markets, but it’s important to recognize that scary days will happen sometimes. That’s part of investing. To the extent we are counting on the markets to help fund our retirements, we are taking on risk, and this is part of what risk looks like. We’ve had an incredible run over the past decade – and hopefully it continues – but it’s important to remember that markets don’t only go up. A day like today, or even a bunch of days like today, doesn’t negate the fundamentals of how the markets work. As hard as it can be to do, we need to stay disciplined and focused on the long-term.

Like this article? Download our free eBook!

Our eBook The 6 Steps to creating your retirement plan helps you on your path t retirement.